How Global Oil Prices Could Influence Singapore’s Condo Market

Singapore’s condominium market is influenced by many global factors, and one of the less obvious yet impactful ones is the...

ECONOMY . BUSINESS . ENERGY

Workship for energy efficiency energy savings. Finance Energy

Coal, natural gasses and oil are non-renewable sources of energy. They are also known as fossil fuels. A large percentage of these non-renewable sources are globally used as the main energy source that people consumes.

Plants, and other decomposing materials such as dead animals and the like are main sources of fossil fuels. They have existed since the beginning of time powering life here on earth. They are very valuable because it takes thousands of years to convert as an efficient source of energy. As of now they are the most accessible and cheapest source of energy because of this fossil fuels are continuously and indiscriminately being exploited. It’s being consumed at a fast rate. This in effect will impact greatly our environment.

Economies around the world use this form of energy and many find it difficult to switch to another form of energy because it is expensive and complicated.

We should shift gear because of its effects and implication to our ever-changing world. As stewards of the earth we are responsible for the future. We should all start by being responsible and accountable energy consumers.

Your home and your belongings are perhaps your biggest asset and your largest financial obligation. You then need to have some form of financial protection to ensure you have the funds needed to pay for repairs or replacements in the event something terrible happens them.

Typically, homeowners purchase a Homeowners Insurance Coverage for three major reasons. One is to provide protection for their assets, like the structure itself as well as the items within. Two is to provide themselves protection from personal legal liabilities, and to provide mortgage lenders satisfaction who usually necessitate homeowners to purchase an insurance.

Homeowners Insurance Coverage

Homeowners Insurance CoverageA Homeowners Insurance provides this financial protection that you require. In the event your home and your belongings are damaged, ruined or lost due to circumstances such as fire, hail, hurricane or robbery, your Homeowners Insurance Coverage could cover or pay for the repair or rebuilding of your home or the replacement of your belongings. There are four types of Homeowners Insurance Coverage that most insurers provide.

Homeowners insurance offered by insurance providers differ with varying limitations as well. Hence, it is imperative that you carefully read and understand the policy before signing. Furthermore, the cost of insurance policies also varies and there are factors that raises or lowers the cost of an insurance policy.

Saving on Homeowners Insurance

Saving on Homeowners InsuranceInsurance providers asses the improvements that you have done to your home and check whether or not these improvements raise the value of your home and/or lessen the risk to insure. Many homeowners make several energy improvements to their homes in order to have both.

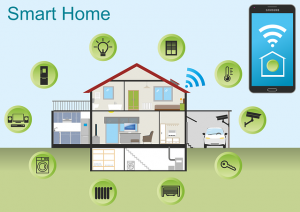

Smart Home technologies and IoT devices are now used by many homeowners as they have the capability to cut wastage on energy, water, heat and cooling, which actually helps you save money on utility bills. Furthermore, by using and installing such devices and technologies in your home, you could save on certain aspects of your homeowners insurance. In fact, there are insurance providers who have started to offer markdowns on these technologies that avoid and eliminate the wastage of natural resources as well as alert homeowners on natural threats.

As the Norwegian oil industry continues to suffer from the lack of demand, the Norges government has all the more reason to focus on its deep-sea mining project.

Currently oil production in the Norwegian Continental Shelf (NCS) has been reduced. The Norwegian government, which plays a more controlling role over Norway’s economies has passed a timely legislature that allows mining explorations on the NCS seabed, where large quantities of valuable minerals and precious metals like gold, silver, copper and zinc can be extracted.

Based on preliminary expeditions, it is widely believed that there is a wealth of already dissolved metals and minerals in submerged areas of the Norwegian Continental Shelf. The NCS seabeds are now being considered as the next most important resources in supplementing land reserves. In pursuing the new economic project, the Norwegian Parliament passed the Mineral Activities Act in July 2019.

Introduced for legislation in January 2019, the Norwegian Parliament saw strong opposition coming from the Norwegian Society for Nature Conservation (NSNC). Silje Ask Lundberg, Chairman of the NSNC expressed disapproval on how policy makers are formulating the legislation that would oversee mineral extraction in the NCS seabeds. Lundberg contended that the authorities have been starting at the wrong end, adding that:

Norwegian policymakers are into developing a law that will allow mineral extraction at sea, without first knowing how that will affect the deep sea’s unique ecosystems.

Even Olav Hallset of Norsk Bergindustri, a trade association that works toward sustainable mining operations, admits that although deep-sea mining presents economic opportunities, it also comes with great risks for the environment.

Norway’s new Mineral Activities Act provides the guidelines in awarding permits for all exploration and recovery of subsea minerals in the Norwegian Continental Shelf, which were mostly based on the legislation for oil and gas operations in the NCS. The following are the key takeaways of the new legislation:

1. All explorations and recovery of subsea minerals will observe environmentally friendly and safe resource management.

2. The Ministry of Petroleum and Energy (MPE) will have the exclusive right and responsibility to manage the resources on behalf of the Norwegian State, which will retain ownership of all unrecovered mineral deposits.

3..In managing the resources, the MPE will first carry out impact assessment before opening a geographical area for mineral activities, and before production licenses for mineral activities will be awarded. .

4. The awarding of licenses will be for a specific geographical area based on public bidding processes; whilst requiring license bidders to submit a detailed plan for recovery and operations, which the licensee will observe all times during mining activities.

5. Production licenses will be in effect for a period of 10 years, and can be extended for a period of 20 years,but subject tomthe condition that all activities at all times were carried out in accordance with the plan for recovery and operations submitted.

6. Upon completion of every recovery from seabed to sea level in a geographical area, the licensee will have ownership of the extracted minerals.

Seabed mining is projected to become a multi-billion industry, which if successful, will make Norway even richer than it already is. That is why Norwegian consumers can easily avail of any of the beste lånene i norge uten kredittsjekk (best loans in Norway without credit check) at their disposal, since they are the main beneficiaries of their country’s economies.

Some people may not notice it, but Fuel has been a very important aspect not only in the automobile industry and transportation but with the General Economy as well.

The rise and fall of gas prices directly affect the nation’s economic status. Higher price means we pay more for gas and less for other services and essentials. When Prices fall on the other hand, it costs a lot less to fill up on gas and so prices of various services such as transportation, trucking and airlines lower prices as well.

Noticing these aspects, we realize that Economics has something to do with everything around us. Finance, Business- even Fuel and Energy.

Before you get into xm 口座開設 and make an investment, it is very important that you make yourself aware of the basic factors that investors are using in breaking down the value of a stock. As we move further in this article, we will be looking at the frequently used ratios and to how it can help you about a stock you are eyeing on.

If you are ready, then let us get this thing started.

This is representing the worth of a company if in the event that it’s sold. This gives useful information as many companies, especially in mature industries are faltering in relation to growth but may still be a great value as per their assets. The book value normally includes the following:

Basically, anything else that can be liquidated similar to bonds and stock holdings.

With mainly financial companies, the book value might fluctuate with markets because these stocks have a tendency to have portfolio of assets that may either go down or up in value. Industrial companies usually have book value as per the physical assets which are depreciating every year.

Possibly, this receives the most scrutiny among other ratios used by investors. If there’s a sudden increase in the price of a stock, then P/E ratio is often the suspect. Stocks may shoot up in value without having big increase in earnings. But, the P/E ratio can decide if it will maintain its trajectory. Without having sufficient earnings to back up its price, sooner or later, the stock will fall down.

One very important thing to be considered is that, you have to compare P/E ratios among businesses in the same markets and industries.

Due to the reason that using P/E ratio is not enough, there are numerous investors who are using price to earnings growth or simply, PEG ratio. Rather than just looking at the earnings and price, PEG is incorporating historical growth rate of the earnings of a certain company. this ratio is going to show how a company’s stock is winning its competitors.

The ratio of PEG is being calculated by means of taking P/E ratio of the given company and then, divide it by annual growth rate of their earnings. The lower the PEG ratio value, the greater the deal an investor can get from the estimated earnings of the stock in the future.

Small businesses have a difficult time taking out a loan compared to large corporations. But even medium-sized companies are already much better off. With limited access to banks and traditional loans, small businesses may opt to take out loans from non-traditional sources such as southeasttitleloans. There are various loans that SMBs may take however the difference is on the interest on top of the principal loan amount.

Small businesses are more likely to be refused credit requests than medium-sized businesses and corporations. This is the result of a current study by the European Commission on the creditworthiness check of SMEs. A total of 200 interviews were carried out for the study with representatives of various stakeholders, including banks, financial organizations, company representatives, national authorities, and regulators. In addition, a survey was conducted through the Enterprise Europe Network that received 466 responses, and another survey in Italy brought 70 responses.

While the average rejection rate for credit inquiries in the EU was 12.6 percent, it was 17.9 percent for micro-businesses and 13.5 percent for small businesses. In contrast, credit inquiries from medium-sized companies were only rejected to 5.7 percent, and inquiries from large corporations only in 3.4 percent of cases. Even with interest rates, the SMEs surveyed still point to problems despite some improvements. 34 percent of those surveyed stated that interest rates had risen in the past six months, but in 2011 it was 52 percent. In other costs, 43 percent of those surveyed saw an increase in the last half of the year – here too, small companies were more affected than medium-sized and large companies.

In an international comparison, it was also found that credit requests from German companies were fully met in 86.8 percent of cases, the rejection rate here was only 2.5 percent.

The second major focus of the study was on the rating systems of the banks and the feedback for the companies. In view of the higher rejection rate, the authors assume that the feedback from the banks is particularly important for the smaller companies, as it can help them with future loan applications.

According to the study, the majority of the loans granted come from banks with internal rating systems (IRB), a share that is expected to increase in the future. Both qualitative and quantitative data flow into the evaluations, with the weighting varying from bank to bank. On average, however, the proportion of qualitative data is 20-40 percent. However, the collection of quantitative data can become a problem for small companies, as they often cannot provide sufficient financial data. The collection of qualitative data is more expensive and tends to be more subjective.

The fact that it is more difficult for small companies to obtain meaningful data as the basis for the assessment could also be the reason why small companies in particular show significantly less interest in their rating at the banks. The most important thing for them is whether and on what terms they receive the desired loan. Even with rejection, some of the study authors say they are not interested in the reasons, but instead look for an alternative loan instead.

Last May 08, 2020, the High Court of Singapore approved HSBC and four other banks’ request to place global oil trader Zenrock under judicial management.

The swift decision came after the motion was filed by the banks last May 04, 2020, in connection with Zenrock’s failure to fulfill the required cash payment to immediately cover the unsecured loans that the oil trader had obtained from several banking institutions. According to Mr. Kiu Hock Yean, the head of HSBC’s Department of Commodities and Energy, their demand for payment came as a result of the sharp fall in the global value oil in the wake of the COVID-19 pandemic.

The demand for payment is part of the agreement when HSBC granted Zenrock a total of US$600 million in unsecured loan. Albeit unsecured, the loan was backed by the oil trader’s US$ 2 billion worth of global trading portfolio.

However, as it became apparent that Zenrock is currently indebted to as many as 23 banks, and with total debts already amounting to US$4 billion, HSBC and 4 other banks quickly filed a request for the High Court to place Zenrock under judicial management, in order to protect their interest and prevent further losses.

The four other banking institutions who jointly filed the application with HSBC, for Zenrock’s judicial management are: Bank of China, Banque de Commerce et de Placements, Credit Agricole and ING Bank.

Concerns over the oil trader’s ability to pay its unsecured obligations were raised when it was learned that Zenrock attempted to secure additional loans from other banks, which involved unlawful pledging of the same oil shipment specifically backing the loans granted by the five banks.

Despite documents submitted by HSBC as proof of Zenrock’s highly questionable actions, and while pending High Court’s naming of the judicial manager who will draw up plans for Zenrock’s debt-restructuring, the firm filed a counter-petition, which included a plea for moratorium of the related freeze order imposed on the oil trader’s assets.

The largeness of the amount of unsecured loans that Zenrock was able to obtain from Singapore banks, are examples of the greater lending authority conferred to banking institutions.

The billions and millions of unsecured loans granted as commercial loans by banks, clearly dwarf the size of unsecured loans that a licensed money lender in Singapore is allowed to extend to a single borrower; $500 to $3,000 at the least if a borrower earns less than $10,000. At the most, licensed money lenders in Singapore can approve a loan of up to six times the value of a borrower’s monthly income if the borrowing individual enjoys a monthly salary of $20,000 or higher.

Just like banks, licensed money lenders in Singapore must make sure that their borrowers fully understand the terms and conditions governing the loan granted.

Covid-19 pandemic has affected the world’s economy in 3 different ways.

As of this writing, not much is known about the virus. While public health officials are still trying to figure out the medical impact of the virus together with certain key elements similar to incubation period, we know that the economic impact will rely on how the general public would react to the virus. Public reaction might allow the disease to spread far and wide or it may create unnecessary costs.

Chinese production had been massively impacted after the Hubei province and other nearby areas were shutdown. Some other countries are beginning to feel its effect as relative authorities are putting them into lockdown as well to prevent the spread of the virus.

Countless of manufacturing companies are heavily relying on imported products from China and several other countries that were affected by the virus. As a matter of fact, many of these companies are relying as well on China in meeting financial goals. With the unimpeded slowdown of the world’s economy as well as transportation restriction, affected countries will definitely be impacted on the level of their production and thus, profitability.

As for those companies that depend on intermediate goods from affected regions and not easily capable of switching sourcing, the severity of impact might depend on how fast the government will react to stop the outbreak. Both small and medium sized businesses might face more difficulties in surviving the disruption that Covid-19 caused. Businesses that are associated to travel and tourism are facing significant losses and most likely not be able to recover that fast.

The temporary disruption of production and/or inputs can cause additional stress on companies, especially to those that have inadequate liquidity. Traders who are using mt4 indicators and others tools might not be able to predict or anticipate which firms may be susceptible. The increasing rise in risk may show that one or several key players in the financial market have bought investment positions that will not yield any profits under current situations, which further weakens the trust in financial market and other financial instruments.

Another possibility is the huge decline in equity markets and also, corporate bond markets with investors prefer to hold on to government securities due to the uncertainty brought by Covid-19.

The Paycheck Protection Program (PPP) is a $349 billion lending legislation of the CARES Act to help America’s small and midsized businesses (SMBs).

The PPP of the Coronavirus Aid, Relief, and Economic Security (CARES) Act is designed to extend government-backed loans not only to for-profit businesses that ordinarily qualify for SBA 7(a) loans. Unlike SBA loans though, the CARES Act PPP includes not only corporations that employ 500 or fewer workers; or business organizations that realize gross annual receipts below the threshold specified for certain industries.

As codified in Section 1102 of the CARES Act, the PPP qualifies the following for PPP eligibility ;

Generally, nearly all small businesses may apply for a PPP loan for as long as a company, proprietor, self-employed individual, independent contractor or freelancer, makes a good faith certification that justifies and ties the need for a loan to the economic uncertainties presented by the Covid-19 crisis.

In which case, a PPP borrower will be required to use the funds mainly for business purposes such as payment for utilities, lease/rent, mortgages plus interests, and in sustaining employee-payroll including claims for vacation, maternity or paternity leaves..

Through the CARES Act, the Small Business Administration assumes responsibility in giving authorization to lend funds under the PPP program, to qualified institutions like banks, insured credit unions and fin-tech companies. Such institutions will serve as additional lending agents to the group of lenders already and previously qualified by the SBA

Basically, the PPP-SBA 7(a) loans extended by lenders are guaranteed by the government by 100 hundred percent (100%) up to December 31, 2020. After said date, the government guarantee under the PPP scheme will revert to 75% for loan values of more than $150,000 and 85% for loans valued at $150,000 and less.

Corporations that borrowed funds through the PPP are barred from declaring and issuing dividends to shareholders. The 1-year restriction will be counted from from the date the PPP loan has been fully settled.

Employers must retain an employment level of at least 90% from March 24 through September 30. 2020.

A PPP borrower must not have received an SBA Economic Injury Disaster Loan from the SBA, which cites financial hardships posed by the Covid-19 crisis as main reason/s.

The loans granted under the PPP of the CARES Act basically falls under the SBA 7(a) loan category. However, it is not clear if a business that has been driven to bankruptcy by the Covid-19 crisis before March 24, 2020, is still eligible to apply for a PPP loan.

The SBA’s lending rules qualify only those with a past bankruptcy that has been discharged at least a few years before applying for an SBA loan.

Nonetheless, corporations or business owners who have already been driven to insolvency by the Covid-19 crisis before the PPP became available, should seek legal help from a bankruptcy attorney. The Covid-19 crisis could have resulted in several bankruptcy cases even before the CARES Act was legislated.

Considering that seven counties in the San Francisco Bay Area had in fact ordered nonessential businesses to close and residents to shelter-in place as early as March 17, 2020. In such cases, a bankruptcy attorney san diego business owners would recommend, will be the likeliest resource person to get in touch with, when contemplating to borrow government-backed funds.

Nobody can predict that exactly yet. For example, the economic department of the industrialized nation’s association OECD expects a decline in the global economic growth of “only” 0.5 percent. That would require a short period of the epidemic.

After that, deferred production and demand would pick up again and compensate for shortfalls. In a negative scenario, OECD chief economist Laurence Boone anticipates a 1.5 percent decline in global economic growth. In the worst case, the current crisis could also plunge the global economy into recession.

Common people believe that it is the government that is constraining businesses. Contrary to popular belief, it is actually the government that is promoting its citizens to engage in business activities. This is as per the reports from New York Times. In some situations though, the government may even help entrepreneurs in launching their business from scratch and nurture it throughout by backing them up with financial advice and assistance.

Being able to get help from the government no matter what form it is, will require an entrepreneur to give inputs to the agencies or initiate a request.

Basically, the government can intervene and provide assistance in a couple of ways and these are through administrative and financial help. It’s the federal government that is executing majority of the financial assistance by means of Small Business Administration or SBA.

SBA is inducing commercial banks in an effort to make loans by means of guaranteeing to pay a percentage of the defaulted loan. Every federal agency is supporting businesses via its own offices; often by means of partnering with them on set government regulations.

Established businesses usually have sufficient resources in keeping up with the changes in the legislation so the government has the tendency to concentrate on assisting smaller businesses. After all, these small businesses have limited options to get their funding from like applying from https://mycaraccidentcashadvance.com/, requesting additional funds from family and friends, crowdfunding etc.

These are agencies that are offering advice and assistance to community businesses. Majority of the agencies have hotlines in helping companies to understand and to stick to the legal statutes either when running or starting a business.

As for the federal government, you can’t expect grants from them. However, it’s job is to distribute money to different states. Then, it’s the responsibility of the state government to hand out this money amongst foundations and charities that is funding small businesses.

According to Walt Minnick, Idaho Representative; he believes that the government can provide better assistance to businesses by means of improving their budget than sending money to smaller businesses that are ready to grow.

As for the business’ part, they can actually save more on tax preparation by going to the website of the IRS. While the IRS might not be able to replace seasoned accountants but at least, they can educate business owners on tax basics.

Are you self-employed and you currently need financing? Borrowing money as a self-employed person can be very difficult. Your main concern is how to secure a loan quickly. Banks often do not provide financing if your company does not meet strict conditions, or demand an enormous amount of collateral in exchange for the loan.

You can borrow from private individuals but this route can be difficult and they often charge a high-interest rate. So how can you best approach borrowing money for a sole trader business?

The labor market has changed considerably in recent years, a permanent contract for an indefinite period has almost become an exception. Employers do not easily give a permanent contract.

Partly as a result of this, the number of freelancers has grown explosively in recent years. Currently, there are more than 1.3 million self-employed people in the Netherlands and this number grows between 40,000 and 50,000 annually.

Banks are often very reluctant to lend money to freelancers due to the unpredictable income. In addition, not all self-employed entrepreneurs have a safety net if they become incapacitated for work or are temporarily out of work.

If you want to borrow money as self-employed, it is important that you are at least 25 years old and that your business is registered with the Chamber of Commerce. There’s a multitude of options available for you. Let’s take a look at the three most common loans available for self-employed individuals.

A good alternative if the bank does not want to lend you money is to take microfinance as a sole trader. This means that you then take out a business loan of a maximum of 50,000 euros. Conditions apply for this. You must be at least 18 years old, living within the area where you are taking the loan, and you must be able to present a clear business plan.

Do you have an interesting and innovative idea like energy-efficient devices? If your idea has a lot of potentials, but you do not have the necessary financial resources to implement your idea, an innovation credit can offer a solution. As a (starting) self-employed person you can apply for this credit type of credit starting with local banks near you or you may contact your local state government for more information on this type of funding. Investigate further as to which banks provide this type of financing.

There is a chance that the application will not be processed, but if you make a thorough preparation and have done good market research, it is more likely that your application will be approved. A good business plan is essential. After a thorough evaluation of your plans, the Central Government will decide whether or not you can get a loan.

Since the rise of social media, crowdfunding has become very popular as a form of financing for starting companies. More and more successful companies are succeeding in achieving exponential growth with the help of this peer-to-peer funding.

Crowdfunding can offer a solution if you as a self-employed person need a relatively large sum of money for your company within a short period of time and there are no banks or lenders who want to lend you money.

When there is a high demand for your product or service from the population, there are probably a large number of people who are interested in the development of your product or service.

These people will gladly offer financial support to your company. In this way, you ask the public to finance your project through various platforms.

Borrowing money as a start-up entrepreneur can be a serious challenge. To become a successful self-employed person you must have a healthy dose of knowledge, expertise, courage, perseverance and often financing to be able to start or grow.

Many business financiers only give credit to companies that have a certain amount of revenue per year. So often not feasible for the self-employed. Fortunately, there are several options that you can use. Investigate, contact the right people, and start your business today.